You spent months perfecting your B2B marketing playbook, finally cracked the code on lead generation, and got your team humming.

Sadly, that playbook is about to become expensive wallpaper.

I’m not exaggerating.

The median B2B marketing budget is growing 1-4% this year while CEOs expect 15-20% revenue growth.

Do the math. It doesn’t work.

Why Old Marketing Playbooks Won’t Work In 2025

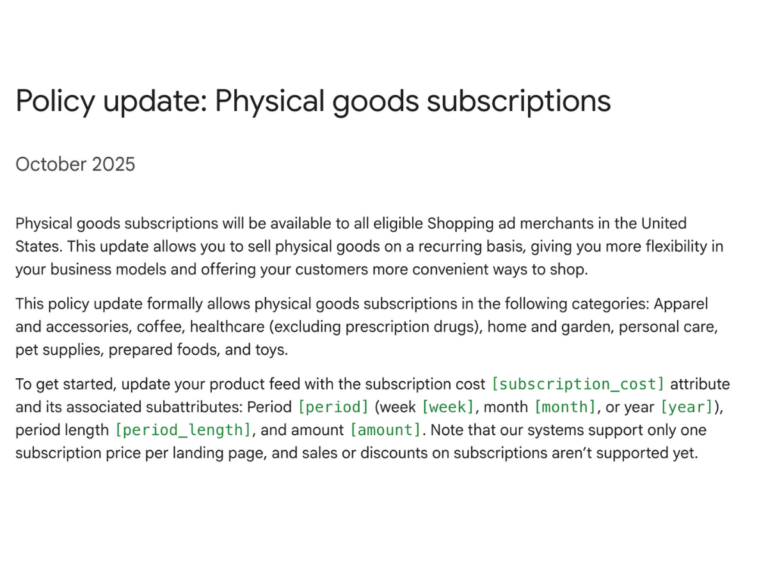

Regulatory Issues: New Jersey and Utah dropped consumer data laws in March 2025 with opt-out mechanisms so strict they make GDPR look friendly.

The EU’s AI Act is already in force, with some parts to come into effect soon, meaning your AI content engine better comply with the rules or you’re in trouble.

| Area | Key Obligation for Marketers | Effective Date |

| AI-generated content | Label/notify users of AI-generated content | Aug 2, 2025 |

| Data/copyright compliance | Use licensed LLMs; ensure summary of training data | Aug 2, 2025 |

| Ban on manipulative uses | No covert AI manipulation or vulnerable targeting | Feb 2, 2025 |

| Deepfake media | Clearly label AI-altered images/audio/video | Aug 2, 2025 |

| AI literacy/training | Ensure staff are trained | Feb 2, 2025 |

| Documentation/oversight | Record-keeping and explainability | Aug 2, 2025 |

Martech Shake-Out: About 8.6% of martech solutions disappeared in 2024. Meanwhile, AI-native startups are launching daily, each promising to revolutionize everything.

Your “stable” vendor stack isn’t stable anymore.

Role Shift: You’re not running campaigns anymore – you’re an adaptive strategist navigating regulatory landmines, managing AI implementations, and proving ROI to increasingly skeptical finance teams.

A recent survey found 72% of CFOs believe CMOs can’t demonstrate clear ROI.

Another study showed marketing leaders reporting burnout at near-record levels.

Connect the dots: the old “more leads, more growth” playbook isn’t cutting it when every dollar needs justification and every initiative needs measurable business impact.

Here are seven strategic plays you’ll need to stay competitive in this landscape.

Play #1: Architect a Responsive Team with Smart Automation

At $5-10M revenue, you’ve got 2-5 full-time marketers.

That’s it.

If you’re trying to cover every marketing function with dedicated specialists, you’re setting yourself up for failure.

What actually works: Strategic generalists backed by AI and smart automation.

The New Team Structure

Core team:

- You: Strategy, budget, board reporting, AI orchestration

- Growth/Demand Gen Specialist: Campaigns, analytics, conversion optimization

- Content/Communications Lead: Writing, social, PR, some design

- Marketing Ops (part-time or shared): Attribution, data, system management

Notice what’s missing? Entry-level roles on tasks that AI handles better and faster.

Automate the Grunt Work (Not the Strategy)

Automate these tasks:

- Campaign briefs and creative concepts (AI generates 10 variations vs. writing one from scratch)

- A/B testing setup and basic analysis (let AI call statistical significance)

- Social media formatting and scheduling (turn blog posts into five platform-specific formats)

- Basic reporting and data analysis (AI spots trends, you act on insights)

But keep human control over:

- Strategic messaging and positioning

- Customer research insights

- Creative concepts and campaign themes

- Stakeholder communication

- Crisis management

Build Your Freelancer Network

You can’t hire specialists for everything, but you can build a reliable contractor network:

- Graphic designer who knows your brand

- Video editor for social content

- Copywriter for specialized projects

- Technical writer for product docs

- Event coordinator

Key point: Find people who can work with AI-generated briefs and raw materials, not create everything from scratch. (Psst: If you’re really committed to high-quality execution and results, we hope you check us out. 😉 )

The Cultural Shift

Your team needs to think like growth operators:

- Everything gets measured – if you can’t tie it to pipeline, question it

- Speed beats perfection – when vendors disappear overnight, adaptability trumps polish

- Collaboration over silos – with 3-5 people, everyone’s work impacts everyone else’s results

Play #2: Build Budget Triggers, Not Static Plans

Your annual budget planning process is broken. Every CMO I talk to says the same thing:

“We built this beautiful budget in January, and by March it was completely irrelevant.”

Traditional budgets assume your best channel keeps performing, tools don’t get acquired, and competitors don’t launch surprise campaigns.

In 2025? Good luck with that.

The Problem with Static Thinking

You allocate $50k to LinkedIn ads based on last year’s performance. In month two, LinkedIn changes its algorithm and your CPL doubles.

Do you:

- Keep spending because “it’s in the budget”

- Shift money to Google Ads, which is suddenly performing better

- Wait until next quarter’s budget review

If you picked A or C, you’re burning money while competitors eat your lunch.

Dynamic Budget Framework

Here are some better examples.

Performance triggers:

- Channel ROI exceeds target by 25% for 30 days → Increase budget by 20%

- Channel ROI falls below target by 20% for 14 days → Reduce budget by 30%

- Cost per SQL drops below $X → Unlock additional $Y in spend

Competitive triggers:

- Major competitor launches campaign → Release emergency response budget

- Win rate drops below target for 60 days → Shift funds to competitive differentiation

Market triggers:

- Economic indicators shift → Adjust brand vs. performance mix

- New regulation impacts targeting → Reallocate to first-party data initiatives

Getting CFO Buy-In (The Key to Everything)

CFOs hate surprises, but they love responsive financial management.

Here’s your pitch:

Frame it as risk management: “Instead of being locked into channels that might stop working, we can quickly shift to what’s driving results.”

Use historical examples: “Last quarter, we kept spending on Facebook for six weeks after performance dropped because it wasn’t time for budget review. That cost us $23k in wasted spend.”

Build in safeguards: Set maximum reallocation limits (no single shift exceeds 30% without approval) and require trigger documentation.

Play #3: Optimize Your Pipeline, Not Vanity Metrics

I met a CEO obsessed with lead generation numbers.

Every week, he’d ask his team, “Why only 147 leads instead of 200?”

Meanwhile, his sales team complained that 80% were garbage.

His cost per lead was fantastic. His cost per customer… Not so much.

If you’re still measuring success by lead volume in 2025, you’re optimizing for the wrong thing.

Kill the Cheap Lead Addiction

Those $5 Facebook leads that make your CPL reports look amazing?

They’re probably costing you more than $50 leads from premium channels.

A veteran CMO put it perfectly: “CPL is perhaps the worst metric ever for CMOs targeting enterprise customers. Low-cost leads are rarely low-cost opportunities.”

Focus on these metrics instead:

Sales-Qualified Opportunities (SQOs): Prospects your sales team actually wants to talk to, not just leads meeting basic criteria.

Pipeline Velocity: How fast do marketing-sourced leads move through your sales process? If your “high-quality” leads sit for six months while competitor leads close in three, you have a targeting problem.

Payback Period: How long to recoup customer acquisition cost? If you’re acquiring customers faster but they take longer to pay back their acquisition cost, your efficiency is getting worse.

Replace Cookies with Intelligence

Since third-party cookies are finally dying, get smarter about first-party data:

Email segmentation beyond demographics: Instead of “VP of Marketing,” think “VP of Marketing at companies growing 50%+ who downloaded our ROI calculator and visited pricing twice.”

CRM enrichment with intent signals: When someone from your target account visits your competitor’s pricing page, you should know about it and have an automated response ready.

Progressive profiling that doesn’t suck: Start with email and progressively collect data through valuable interactions. Each content download, webinar attendance, and page visit adds to their profile without feeling invasive.

Stop Optimizing for These Vanity Metrics:

- Social media followers and engagement rates (unless you can tie them to pipeline)

- Email open rates (deliverability matters more)

- Website session duration (unless it correlates with conversion)

- Content download volume (quality over quantity)

- Brand awareness surveys (unless connected to purchase intent)

Play #4: Treat AI Like a Junior Team Member Who Needs Management

You’ve heard the story: a CMO got excited about AI and started using ChatGPT for everything.

Within six weeks, her content output tripled – daily blog posts, hourly social media, daily emails instead of weekly.

Her conversion rates crashed by 40%.

It’s what happens when you only measure content velocity and not content quality.

AI needs management, training, and quality control.

When to Automate vs. Augment

Automate the predictable:

- Social media scheduling and formatting

- Email subject line variations for A/B testing

- Basic ad copy iterations

- Research and competitive analysis

- Meeting notes and follow-up summaries

Augment (not replace) the strategic:

- Strategic messaging and positioning

- Customer research and persona development

- Creative concepts and campaign themes

- Stakeholder communication and board reporting

- Crisis management and reputation issues

Avoid AI Vanity Metrics

Don’t get excited about:

- Content volume increases (unless engagement holds steady)

- Faster campaign deployment (unless performance improves)

- More social posts (unless social drives pipeline)

- More keyword variations (unless you’re winning auctions profitably)

Report Real AI ROI

Your CFO doesn’t care whether you’re using AI or ancient magic scrolls. They care about business impact:

Time savings that translate to capacity: “AI-assisted content freed up 15 hours per week, allowing two additional campaign experiments monthly.”

Cost per SQL improvements: “AI-optimized ad copy reduced cost per sales-qualified lead from $180 to $140 while maintaining quality scores.”

Campaign-to-pipeline lift: “AI-powered email personalization increased email-to-meeting conversion from 2.1% to 3.4%, generating $47k in additional pipeline.”

Red Flags to Watch For:

- Content starts sounding generic or similar to competitors

- Team stops thinking strategically because “AI will handle it”

- Quality control gets sloppy because output “looks good enough”

- Customer feedback mentions communication feels “robotic”

Play #5: Balance “Brandformance” with Sales Reality

A client wanted to “build the brand” after their competitor got featured in Forbes. They allocated $75k to PR, started a podcast, and launched thought leadership.

Six months later: nice logo recognition, zero additional pipeline.

Meanwhile, their competitor was quietly investing that budget in targeted account-based campaigns and closing deals.

Here’s the thing about brand building: it matters, but only if it’s tied to performance.

Welcome to “brandformance.”

Why Brand Matters (But Differently Than You Think)

Valtech research shows 60% of industrial B2B leaders report increased engagement from brand investments.

But they’re not talking about logo redesigns – they’re talking about differentiated positioning that makes sales conversations easier.

When prospects understand what you do differently before the first sales call, your close rate goes up.

When your brand stands for something specific, you stop competing on price. When you have clear industry perspectives, you attract expertise-seeking leads, not just vendor shoppers.

The Three-Tier Investment Model

Tier 1: Sales-Aligned Thought Leadership (60% of brand budget)

- Create content answering objections your sales team hears daily

- Position executives as experts in areas where you want to win deals

- Develop frameworks and methodologies that become synonymous with your brand

Tier 2: Competitive Differentiation (25% of brand budget)

- Study what competitors say and say something genuinely different

- Create comparison content that guides prospects toward your strengths

- If everyone talks “innovation,” you talk “practical results”

Tier 3: Long-term Brand Building (15% of brand budget)

- Industry awards meaningful to your buyers

- Speaking at events your prospects attend

- Strategic partnerships enhancing brand positioning

Brand by Business Model

SaaS Companies: Your product experience IS your brand. Every email, in-app message, and support interaction shapes perception.

Professional Services: Your brand is your people’s expertise. Invest in personal branding for executives and case studies showing measurable outcomes.

Manufacturing/Industrial: Your brand is capability and reliability. Focus on technical content demonstrating expertise and problem-solving case studies.

The Brandformance Test

Before any brand investment, ask:

- Will this make sales conversations easier?

- Does this differentiate us in ways that matter to buyers?

- Can we measure business impact within 6 months?

- Does this align with where we want to win?

- Would our sales team voluntarily use this?

You need “yes”es on at least 4 out of 5, or find a different investment.

Play #6: Run 90-Day Test Cycles, Not Annual Campaigns

I watched a CMO spend eight months building the “perfect” content marketing program. Forty-seven pieces of content, elaborate nurture sequences, great fanfare.

It flopped. Hard.

By the time they realized the messaging was off, they’d burned $180k and eight months of learning that could have happened in eight weeks.

Why 90-Day Cycles Work

Marketing tactic half-life is shrinking. That LinkedIn strategy working great in Q1 might be useless by Q3 due to algorithm changes, competitor responses, or market shifts.

Ninety days is long enough for meaningful data, short enough to fail fast without catastrophic budget burn.

The 30/60/90 Framework

Days 1-30: Rapid Validation

- Week 1: Launch with 70% certainty (don’t wait for perfection)

- Week 2: Daily monitoring for real indicators (clicks, conversions, sales excitement)

- Week 3: First optimization (double down on winners, pause clear losers)

- Week 4: Assessment (clear winner = scale, clear loser = kill, promising = iterate)

Days 31-60: Smart Iteration

- Audience refinement based on month 1 response data

- Message optimization using actual engagement feedback

- Channel mix adjustment following performance, not assumptions

- Creative fatigue monitoring and fresh creative preparation

Days 61-90: Scale or Kill Decision

Scale indicators:

- Cost per SQL at/below target and stable

- Consistent positive lead quality scores from sales

- Pipeline attribution tracking toward payback goals

- Channel capacity exists for profitable spend increase

Kill indicators:

- Performance plateaued despite optimization

- Cost per acquisition trending upward with no clear fix

- Consistently negative sales feedback on lead quality

- Channel saturation limiting scale potential

What to Track (And Ignore)

Week 1-2 Early Signals:

- Click-through rates (baseline establishment)

- Landing page conversion rates (message-market fit)

- Sales development response rates (lead quality proxy)

Month 1 Assessment:

- Cost per Marketing Qualified Lead

- Lead-to-opportunity conversion rate

- Sales team feedback scores

Month 2-3 Business Metrics:

- Cost per Sales Qualified Opportunity

- Pipeline attribution and velocity

- Customer acquisition cost trends

Don’t Get Distracted By:

- Brand awareness surveys (too early)

- Social engagement (unless social is primary channel)

- Email open rates (deliverability matters more)

- Website traffic increases (unless traffic converts)

Red Flags That Kill Tests Early

Week 4: Zero qualified leads despite reasonable traffic, sales refusing to follow up, fundamental message-market fit problems

Month 2: No improvement from optimization, competitive responses neutralizing advantage, significantly increased channel costs

The Test Portfolio Approach

Don’t run one big test – run multiple smaller tests:

- High Probability, Lower Impact (50% of budget): Optimization of existing channels

- Medium Probability, Medium Impact (30% of budget): New channel experiments

- Low Probability, High Impact (20% of budget): Completely new approaches

This ensures constant learning while maintaining predictable performance.

Play #7: Report Like a Growth CFO, Not a Creative Director

Two CMO board presentations, same week:

CMO #1: Beautiful slides about “brand evolution,” 20 minutes on impression metrics and creative concepts.

CFO interrupted: “How much pipeline did this generate?”

Fumbling through backup slides. CEO started checking email.

CMO #2: One slide – “Marketing drove $2.3M in new pipeline this quarter, up 34%, at $1,847 blended CAC.”

Room went quiet. Fifteen minutes walking through exactly how that happened and what needed to change.

CFO asked for dashboard copy. CEO asked if she needed more budget.

Guess which CMO got renewed?

Start with the Money

Your board presentation should answer one question in 30 seconds: “Is marketing driving profitable growth?”

Opening Slide Format:

- New Pipeline Generated: $X.X M (vs. $X.X M last quarter)

- Blended Customer Acquisition Cost: $X,XXX (vs. $X,XXX target)

- Marketing-Sourced Revenue: $X.X M (XX% of total revenue)

- Pipeline Payback Period: X.X months (vs. X.X month target)

Four numbers. Complete story.

The Metrics That Keep Executives Awake

Customer Acquisition Cost and Trends: Not just the number – direction and why. If increasing, what’s your fix? If decreasing, is it sustainable?

Marketing-Sourced Pipeline %: How much company growth depends on marketing? Track the trend and sales capacity to handle more.

Pipeline Conversion Velocity: How fast do MQLs become customers? Reveals both lead quality and sales execution.

Payback Period and LTV:CAC: Recovery time and lifetime return. Board members understand these because they apply to every business decision.

Handling Tough Questions

“Why is CAC increasing?”

- Don’t: Blame market conditions

- Do: “LinkedIn CAC increased 23% due to iOS targeting changes. We’re shifting 30% of budget to email and direct mail, which should reduce blended CAC by 8% next quarter.”

“How do we know marketing is working?”

- Don’t: Point to brand metrics

- Do: “Here are 15 deals from last quarter worth $847k where marketing was primary influence, plus specific touches contributing to each.”

“Should we cut marketing budget?”

- Don’t: Argue about brand importance

- Do: “Cutting budget 20% would reduce pipeline by approximately $400k based on current conversion rates, translating to $200k less revenue next quarter.”

The Budget-Increase Secret

Build your case that marketing is a profit center, not cost center:

- Show month-over-month efficiency improvements

- Demonstrate additional budget will generate predictable returns

- Prove you can measure and optimize performance real-time

- Present marketing as scalable growth engine

When board members see marketing as a reliable growth driver with measurable returns, budget conversations become easy.

When they see it as creative expense with unclear results, you’ll defend every dollar.

Report like you’re running a P&L, because you are. Your P&L just happens to be customer acquisition instead of product sales.

Prove you can generate profitable returns on invested capital, and you’ll never worry about budget cuts again.

Next Steps:

These seven plays aren’t meant to be implemented simultaneously. With tight budgets and limited bandwidth, every strategic choice means saying no to something else.

If you’re fighting for credibility with your CFO: Start with Play #7 (reporting) and Play #3 (pipeline optimization). Get your numbers clean and your story straight before adding complexity.

If your team is burned out or overwhelmed: Lead with Play #1 (team architecture) and Play #4 (AI management). Free up strategic thinking time before tackling bigger organizational changes.

If you’re losing competitive battles: Focus on Play #5 (brandformance) and Play #6 (testing cycles). You need market positioning and rapid iteration more than operational efficiency.

If your growth has stalled: Prioritize Play #2 (budget triggers) and Play #6 (testing). You need to find new growth levers, not optimize existing ones.

If you need strategy or execution help, consider jumping on a quick free strategy call with our specialists at Digital Position.

We’ll help identify your biggest growth opportunities and figure out the biggest high-leverage plays for your situation.

Even if you decide we’re not the right fit, you’ll walk away with clear insights on what’s currently working, so why not book your no-obligation strategy call today?

no replies