Q4 is coming up fast, and if you’re not preparing now, you’re behind. We pulled together a clear, actionable playbook to help you get the most out of your spend and strategy from mid-September through the end of the year.

This is based on real performance data, trends we saw last year, and how consumers are already behaving in 2025.

Here’s what you need to know 👇

Q4 Shopping Behavior: What Changed Last Year

We looked at performance across dozens of accounts, Prime Day trends, and last year’s Q4 results to get ahead of what’s coming. Buyer behavior keeps evolving, and brands that aren’t adapting will fall behind. The biggest shift? Shoppers are spending more time browsing, waiting, and comparing before they buy, especially during the holiday season.

Top-of-funnel performance will feel soft early on, and that’s okay. The brands that lean into awareness early, and understand when to ramp spend, will be in the best position once the real conversion window hits.

Here’s what we’re seeing:

- Buyers are waiting longer. Prime Day showed a longer consideration window before purchases. This pattern will continue into the holiday season.

- October is a top-of-funnel play. Focus on UGC and brand awareness to fill the pipeline.

- 7DC attribution alone isn’t enough on Meta: Add 1-day view tracking by mid-September to capture more conversions.

- September and October may feel soft. That’s expected, shoppers are waiting for deals.

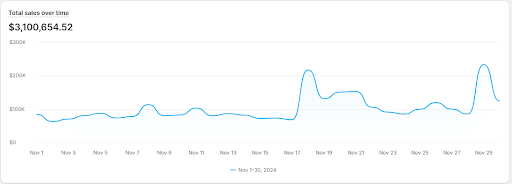

- Holiday shopping keeps starting earlier. Black Friday matters, but it’s no longer the main driver. Revenue is shifting earlier into November.

- Thanksgiving Day = game time. Last year, spend picked up Thursday evening. Budget accordingly.

- Consumers want deals. They’re trained to expect bigger discounts. Many waited until Cyber Monday in 2024.

- Post-Cyber Monday slowdown is short. Sales dip briefly, then ramp back up until mid-December.

- Don’t forget Q5. December 27 to mid-January sees strong volume. Focus on gift card redemptions, returns, and promo-hunters.

- Push “New Year, New Me” campaigns if you’re in fitness. For brands with extra inventory, it’s a great time for “End of Season” or “New Year’s Clearance” campaigns

Use this data to guide your strategy from the start, not just react to what’s happening in the moment. When you understand how shoppers are behaving and plan around it, you avoid panic, make smarter budget decisions, and put your brand in the best possible position to win when it matters most.

The Election Will Not Be a Factor in 2025

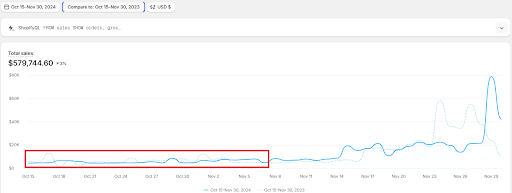

We saw firsthand how the 2024 U.S. presidential election disrupted holiday shopping patterns. From late October into early November, particularly between October 21 and November 10, sales across our portfolios dropped noticeably, especially in battleground states. CPCs rose a bit, and performance dipped while consumers were glued to election coverage.

But we learned a lot:

- Shoppers still need to buy holiday gifts, regardless of political news.

- The 2025 election schedule gives us a break. With the election set for Tuesday, November 4, and no major office races, there’s more breathing room before and after key shopping events.

- Election clarity helps the market. When voters know the outcome, consumer focus returns, and quickly.

Here’s what that means for this year:

- We won’t see a sales lull because of the election this year. Shopper attention won’t be tied up in national political drama.

- Ramp-up needs to start earlier. With fewer distractions and more clarity, there’s more runway to build momentum before Black Friday.

- A smoother cadence means shorter recovery times between election-related news and holiday buys, keeping your spend efficient and driving stronger conversion velocity.

Bring this insight into your planning rhythm. It’s good to get in the habit of making data-based decisions, which will help you capitalize on your opportunity before it goes away!

Spend Allocation: Month-by-Month Breakdown

How and when you spend matters more than ever. Here’s how to break it out:

Mid-September & October

This is the time to build your funnel. Shoppers aren’t buying yet, but they’re definitely browsing. If you wait to show up until November, it’s already too late, your competitors will be ahead.

This phase is all about reach, education, and generating interest that you’ll convert later. Paid social and upper funnel content win here because they plant the seed before deals start hitting.

Here’s how to spend:

- Shift heavy into social. Prioritize Meta, TikTok, and UGC to get your product in front of cold audiences.

- Focus on brand awareness and education. Let people know who you are and why you matter before they start comparing deals.

- Use “best of the year” UGC. This type of content performs well when users are in research mode.

- Run 90% prospecting during this time. Don’t worry if conversion ROAS looks soft, it’s not about converting yet.

- Lower intent in search is normal. Users aren’t actively looking for your brand or products, they’re mentally preparing for BFCM.

Think of this month as planting seeds. You won’t see results right away, but the brands that build demand early are the ones that scale efficiently in November. If your funnel is empty when the buying starts, you’ll have to pay a lot more to play catch-up.

November

This is the ramp-up. Most brands are tempted to hold back until Black Friday, but with shopping starting earlier every year, that approach is very risky. You don’t want to be the brand that waits too long and then scrambles when conversions spike. Instead, use early November to scale smoothly and avoid traffic bottlenecks.

You’ll see clear signs when the time is right to push: better click-through rates, stronger ROAS, and more people returning to your site. That’s when you lean in.

Here’s how to spend:

- Start shifting budget earlier in the month. Don’t wait until Thanksgiving week.

- Watch search and retargeting performance closely. Efficiency will tell you when buyers are ready.

- When performance improves, push. You’ve already built demand in October, now it’s time to activate it.

- Keep your search budgets uncapped. Don’t miss out just because your campaigns are hitting artificial limits.

- Retargeting becomes viable again. Increase spend, but monitor for diminishing returns.

This is the moment you’ve been prepping for. Use the data to lead your strategy, not just chase results. When you see performance jump, act fast. If you built your funnel correctly, November is when it pays off.

December

The buying window tightens, but intent is high. This is the sprint. Shoppers know what they want, they’re checking deadlines, and they’re ready to buy, as long as they can get it in time. You have a short but powerful opportunity to convert, especially leading up to shipping cutoffs.

After the cutoff hits, volume drops, but don’t shut off completely. Just shift how and where you spend.

Here’s how to spend:

- Front-load December spend. Use around 70% of your monthly budget before shipping cutoffs.

- Build urgency into your campaigns. Shipping deadlines drive conversions.

- Dial down spend during Christmas week. Traffic is there, but intent is low.

- Pick spend back up on December 27. Q5 demand is real and starts quickly.

- Start prepping “New Year” messaging before the holiday ends. Be ready to launch campaigns right after Christmas.

December is about timing and urgency. You’ve already done the work, now it’s about making the most of every conversion before deadlines hit. Then, get ready to ride the second wave of demand as gift cards and returns drive another surge.

Ad Copy & Creative Best Practices by Month

Your ad copy & creative needs to shift as buyer intent evolves. What works in October won’t cut it in December. If you’re still using generic product messaging during BFCM or missing urgency around shipping deadlines, you’re leaving revenue on the table.

We’ve tested and optimized this approach across hundreds of campaigns. These are the patterns we’ve seen drive performance, and they’re easy to build into your strategy right now.

October

Shoppers are window shopping. They’re scrolling, comparing, and figuring out which brands they’ll come back to later. This is when your job is to build interest, not pressure people to buy. Soft seasonal messaging works here, lean into fall, gifting, and “best of” language to make your product feel relevant without being too aggressive.

The right creative here sets the tone. It introduces your product, highlights why it’s a great gift, and keeps you top-of-mind when people are ready to convert later.

What to do:

- Shift messaging to fall and early holiday themes. No need to go full BFCM yet, just start warming people up.

- Use softer CTAs like “Explore” or “Learn More.” Lower intent = lower pressure.

- Frame your product as a great gift idea. Start planting the seed.

- Use UGC quotes, reviews, or “favorite of the year” language. It feels organic and builds credibility.

- Test broader audiences with less salesy creative. October is your chance to find what resonates before cost spikes.

Don’t force conversions. This is about building demand. When done right, your October copy makes everything else in Q4 work better, because it creates context, trust, and interest early on.

November

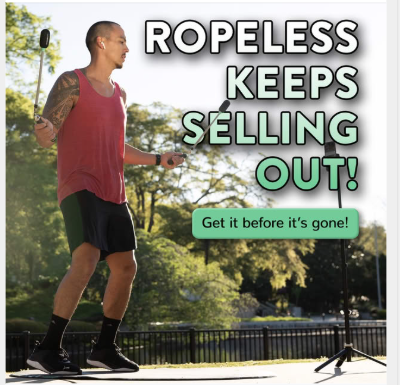

This is your moment to sell. People are actively hunting for deals, gift ideas, and must-haves. And they’re looking at ads like they’re flipping through a catalog. If your copy doesn’t look like a deal or feel like a recommendation, you’ll get scrolled past.

Your job is to show up like a curated shopping guide: helpful, clear, and packed with value. Every word matters here, especially in headlines.

What to do:

- Use “Best Of” language, like they’d see in a holiday article.

- “Best Gifts for Runners”

- “Top Deals on Wellness Must-Haves”

- “Editor’s Pick: 40% Off Best-Selling Gear”

- “Best Gifts for Runners”

- Make the offer clear. Don’t bury discounts in body copy, put them in the headline.

- Highlight bundles or exclusives. “Holiday Exclusive: The [Product Name] Set”

- Keep it tight. Short, value-forward copy outperforms long-winded descriptions.

- Use seasonal imagery and color schemes. Your ad should feel like a holiday promotion at a glance.

November is about making it easy for someone to say, “Yep, that’s the gift I was looking for.” If your copy sounds like a product listing, it won’t work. If it reads like a curated gift guide, it’ll convert.

Black Friday / Cyber Monday

This is the most aggressive window of the season. Every brand is promoting something, and inboxes and feeds are flooded. If your copy doesn’t stop the scroll, or if it’s confusing for even one second, you lose the click.

This is where clarity and urgency are non-negotiable. Vague “tiered” sales or unclear bundles will get crushed by cleaner, simpler messaging.

What to do:

- Lead with the offer, loud and clear. “40% Off Sitewide” or “Buy 2, Get 1 Free”

- Use “Up to” messaging only if you clarify the max discount. E.g., “Up to 50% Off, Best Sellers Included”

- Avoid complicated promo structures. Shoppers won’t stop to decode your sale.

- Use emojis like 🎁 or 🔥 to grab attention. They boost CTR during high-traffic periods.

- If running a tiered offer, visualize it. Use graphics or ad copy that clearly shows price breaks.

This is your most competitive window of the year. Don’t get fancy. Get clear, get loud, and be the easiest brand to understand in someone’s feed.

December

The focus shifts again. Early December is still strong, but urgency starts to matter more each day. Shipping cutoffs become the biggest factor in whether someone buys now or keeps browsing.

If you’re still using generic discount copy by mid-December, you’re not speaking to where the customer is at. They’re done hunting for deals. They’re now asking: “Will it arrive in time?”

What to do:

- Keep running gift guide-style ads if they’re still converting. If it’s working, no need to stop.

- Add urgency tied to shipping.

- “Order by 12/15 to get it in time”

- “Last Chance for Delivery Before Christmas🎁 ”

- “Order by 12/15 to get it in time”

- Use “Final Hours” messaging in the last 3–4 days. This avoids daily creative updates.

- Highlight fast shipping. Especially if you’re competing with Amazon, this is a major lever.

- Promote Buy Now, Pay Later options. Helpful for buyers finishing up big holiday lists.

December copy needs to push action, without overwhelming the shopper. Your tone should be confident, helpful, and focused on logistics just as much as the product itself.

Strategies You Don’t Want to Skip

Here’s what we recommend:

- Buy Now, Pay Later (BNPL)

This option consistently drives stronger performance, especially as budgets get tighter closer to the holidays. Customers are more likely to complete larger carts when BNPL options like Afterpay, Affirm, or Shop Pay Installments are visible in both ads and PDPs.

- Fast & Free Shipping

If you can offer 2-day or expedited shipping, say it clearly in your copy. Competing with Amazon? You may have to take a margin hit on logistics to win the sale, but you’ll gain first-party customer data, and that’s more valuable long-term. - Promote delivery confidence.

Add shipping timelines to your ads and product pages. If someone’s buying a gift, delivery certainty is more important than price. - Make returns easy and visible.

Holiday shoppers want to know that whoever receives the gift can exchange or return it easily if needed. Position this clearly on PDPs and in footer messaging. - Clearly outline holiday support.

Consider building a “Holiday FAQ” with delivery timelines, return policies, and gift card info. Link to it from key ads and email campaigns.

These simple tactics build buyer trust and remove hesitation. It’s not just about having the best deal, it’s about making the buying decision feel easy. If you remove all the friction, your conversion rates will reflect it.

Promotions & Bundles

Promotions should be simple, clear, and competitive. More importantly, they need to drive value without overwhelming your customer. Bundles can play a huge role here, boosting AOV while giving buyers the “deal” they’re looking for.

What we’ve seen work:

- Increase discounts for BFCM: If your baseline discount is 20%, go bigger, 30% to 40%, to cut through the noise.

- Keep promo messaging simple: One clear, direct offer works better than a complicated tiered system. People don’t want to do math to understand your sale.

- If you do run tiered offers, explain them visually: Show “Buy 2, Save 20% – Buy 3, Save 30%” in creative or infographics, not just in body text.

- Bundle top-selling items: Create a “Holiday Kit,” “Best Sellers Bundle,” or “Starter Pack” that feels exclusive.

- Push stocking stuffers or small add-ons: Highlight them in cart or product pages to increase AOV.

- Use Gift with Purchase, but do it right: The “gift” needs a high perceived value, even if it’s low cost. Think something that feels worth 20–30% of your AOV.

Use September to lock in your promo strategy. You want campaigns launched smoothly, not scrambling the week of Black Friday. The brands that prep early avoid last-minute mistakes, protect margins, and scale cleanly when the volume hits.

Build Gift Guide Campaigns That Convert

Gift guides are one of the most reliable strategies in Q4. Why? Because they match exactly how people shop during the holidays. Shoppers don’t want to scroll through endless category pages. They want you to tell them, “Here are the best gifts for your dad, under $50.”

Guides don’t just help with navigation, they frame your products in a way that’s easier to buy. The more specific the guide, the better it performs.

Here’s how to do it right:

- Create multiple gift guides: Segment by price (“Gifts Under $25”), persona (“Gifts for Runners”), or purpose (“Stocking Stuffers”).

- Build shoppable landing pages: Don’t just write a blog post, create full collections that people can add to cart directly from.

- Ask your SEO team to optimize these pages: Target long-tail search terms like “Best gifts for new moms” or “Holiday gifts under $50.”

- Run carousel ads with different guide cards: Each card can be a different persona, price point, or theme, great for social.

- Use clear CTAs like “Shop the Guide” or “Find Their Gift.: These perform better than generic “Learn More” language during Q4.

When done right, gift guides drive higher AOV, stronger time on site, and faster conversions. They remove decision-making friction and feel helpful, not salesy. Make sure you have several live by early November to catch both planners and last-minute shoppers.

Let’s Make This Your Best Q4 Yet

You’ve got what you need to make this Q4 count. The brands that win are the ones that plan ahead, stay flexible, and don’t panic when things look quiet early on.

Stick to the strategy, stay consistent, and you’ll be in a great spot once the real volume starts rolling in.

And if you want a second set of eyes on your Q4 plan, or just need help bringing it all to life, reach out and book a call with our team. We’re here to help you crush it.

Q4 Marketing Playbook FAQ

Q: Why does performance dip in September and October? Should we be worried?

Nope, it’s normal. Shoppers are in research mode, not buying mode. If performance feels soft, that doesn’t mean the strategy is broken. It means you’re building demand early, which leads to stronger results in November and December.

Q: Do I really need to start spending heavily in October? Isn’t that too early?

Yes, you do. October is when you fill your funnel with cold traffic. If you wait until November, you’ll spend more to get the same people. 90% of spend in October should go to prospecting, not converting.

Q: When should I expect performance to pick up?

We usually see the first signs of strong performance around the second week of November. Expect real volume to ramp up by Thanksgiving evening and surge through Cyber Monday. Another bump comes post-Christmas, starting around December 27.

Q: How do I know when to scale spend in November?

Watch your retargeting and branded search performance. When click-through rates improve and ROAS starts rising, that’s your sign to push budget. Don’t wait for Black Friday if performance is already strong.

Q: What kind of ad copy works best in each phase of Q4?

- October: Educational, soft, fall-themed. Use gift guide language and UGC.

- November: Harder selling. Focus on gift lists, exclusives, and clear value.

- BFCM: Clear and aggressive. No fluff. Lead with discounts and urgency.

- December: Urgency-focused with shipping cutoffs, gift ideas, and BNPL messaging.

Q: Is the election going to mess with our performance again?

No. 2025 doesn’t have a presidential election, so we don’t expect any major distractions. Unlike last year, there’s more space between early November and BFCM. If anything, this year’s setup gives you more room to ramp spend earlier.

Q: How much should we spend before vs. after shipping cutoffs?

Roughly 70% of December’s budget should be spent before the shipping cutoff. After that, scale down during Christmas week, then ramp back up around December 27 for Q5.

Q: What’s Q5?

Q5 is the time between December 27 and mid-January. It’s a mini second season where shoppers use gift cards, make returns, or grab last-minute deals. You’ll often see another revenue spike here, especially if your campaigns are ready to go.

Q: Should we build gift guides even if we’re a smaller brand?

Yes. Gift guides help buyers make quicker decisions. Break them out by price or persona. Even a basic “Gifts for Her” or “Stocking Stuffers Under $25” page can drive strong conversion.

Q: How can I boost AOV during Q4?

Use bundles. Create exclusive kits with top sellers or build gifting-specific packages. Promote small add-ons during checkout and push “Gift with Purchase” offers that feel valuable. Shoppers want deals, but they also want to feel like they’re getting more.

Q: What if our BFCM promo is the same as what we run all year?

That won’t be enough. You need to go bigger or change the offer structure. If you usually do 20% off, try 30–40%, add a bundle, or include a GWP to increase perceived value. Your promo has to feel different to grab attention.

no replies