BrickHouse Nutrition’s 2025 results are a great example of how modern ecommerce growth actually works when customers research, compare, and distrust everything by default…

especially in competitive categories like supplements.

As soon as 2025 ended, we reviewed the spreadsheets, crunched the numbers, and tallied up all the wins and losses from this 7-figure spend, and we’re sharing everything we learned.

Here are the 8 lessons that matter most if you’re an e-commerce brand owner.

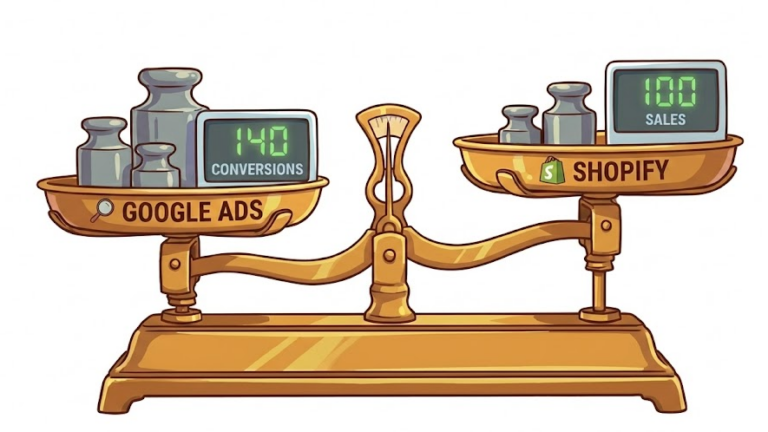

1. Shopping traffic now functions as mid-funnel discovery.

When we shifted Google spend away from Performance Max and toward Shopping campaigns, traffic became more consistent, but conversion rates declined.

That outcome is expected once you account for how customers use Google Shopping. Sure, they buy, but most of them aren’t ready to buy yet. They’re still evaluating.

Shopping clicks frequently followed this pattern:

- Compare products and pricing

- Scan reviews and guarantees

- Leave to research elsewhere

- Return later through a different channel

Conversion rates improved once we added stronger consideration support:

- Research-focused blog content

- Comparison and positioning pages

- Clear credibility signals

- Explicit expectation-setting

Takeaway:

Shopping drives evaluation. Conversion depends on the quality of the consideration layer that follows the click.

2. Creative Matters More in Shopping Than Most Brands Admit

We tested non-traditional Shopping images (moving away from sterile white-background shots) and saw immediate gains in click-through rate. Listings that provided visual context outperformed sterile, standardized product shots.

Performance improved when we optimized the feed for:

- Visual differentiation at a glance

- Clear value cues before price comparison

- Engagement signals within the auction

Product titles followed the same pattern, and including language about the 60-day guarantee increased interaction without needing discounts.

Takeaway:

Shopping feeds behave like creative units. Performance improves when they are designed intentionally.

3. Performance Max Only Works When You Control the Inputs

PMAX is unforgiving. It requires complete creative and messaging control to work consistently.

When we tried to treat it as a shortcut, we lost brand clarity and performance.

If you don’t supply:

- Clear creative

- Intentional asset groups

- Tight messaging guardrails

Google will fill the gaps with whatever it thinks might work. Campaigns with unclear creative direction performed like garbage.

However, when we took the time to provide:

- Deliberate asset groups

- Controlled creative inputs

- Explicit messaging guardrails

We got much more reliable results.

Takeaway:

Use PMAX only when you can fully design the campaign. Otherwise, it designs itself…poorly.

4. Brand Defense Responds to Content Faster than Bidding

In 2025, we faced multiple competitor attacks on branded terms.

Instead of just increasing bids, we published targeted blog content addressing misleading claims.

That content outranked attack ads, and it actually triggered direct conversations with competitors. They agreed to pull back on the attacks.

This is the overlooked reality of modern paid search:

SEO + content can neutralize paid threats faster than bidding wars.

Takeaway:

If competitors are hijacking your brand, your best weapon may be education rather than ad spend.

5. Third-Party Validation Drives Clicks. Organic Rankings Drive Sales.

Consumer Best Reviews delivered thousands of clicks and strong credibility.

But:

- Most conversions still happened through organic discovery

- Ranking those reviews organically was difficult

The real insight:

- Third-party validation works best when buyers find it during research.

- It wasn’t nearly as effective when it was pushed to them

So we’re prioritizing PR placements with major health publications for 2026.

Takeaway:

Credible content must live where customers look for reassurance.

6. YouTube Isn’t a Branding Channel Anymore

BrickHouse’s YouTube learnings were unusually clear.

Consistent results included:

- Lower CPMs and higher conversion rates from Shorts

- Stronger performance from UGC than polished creative

- Podcast host reads about succeeding on Google placements

We found the best practice to be pushing video 30 days before a sale and measuring conversions 30 days after.

Takeaway:

YouTube influences purchasing earlier in the decision cycle and drives delayed conversions that don’t show up in short attribution windows.

7. Product-Only Ads Fail for Researched Products like Supplements

Across Google and Meta, product-only ads showed limited scalability.

Performance improved with content that supported evaluation:

- Comparisons and cost framing

- Ingredient transparency

- Realistic timelines and expectations

Research-driven messaging consistently outperformed direct product pitches.

Takeaway:

Education accelerates trust in categories where buyers research before purchasing.

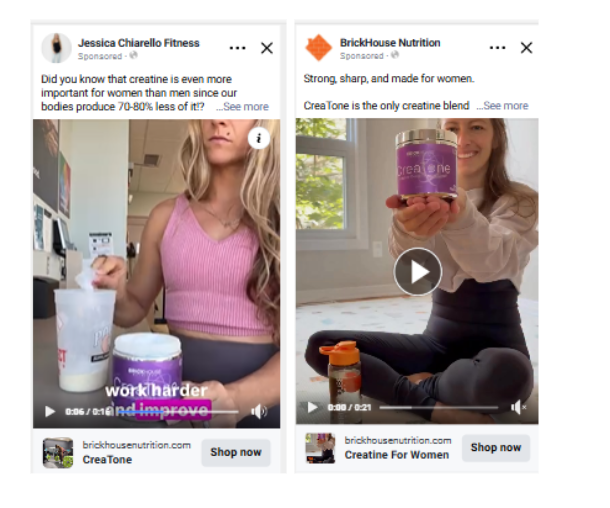

8. Meta Scaling Is a Creative Volume Problem, Not a Targeting Problem

Whenever we tested 18–20+ new ads per month, everything scaled more reliably.

Separating budgets by creative angle surfaced winners faster, and whitelisted creator content consistently outperformed standalone UGC thanks to inheriting social proof.

Simple sale messaging outperformed clever language.

Over-engineered formats, political endorsers read, and unsupported Spanish ads underperformed.

Takeaway:

Meta rewards creative volume and velocity. Targeting refinements matters less at scale.

What E-commerce Marketers Should Do in 2026

If you’re running paid media in 2026:

- Build research content for every major SKU.

- Treat Shopping feeds like creative assets.

- Use PMAX intentionally or don’t use it at all.

- Invest in whitelisted creator partnerships

- Measure video on delayed impact, not last click

- Align attribution with how customers actually buy

- Expect competitor interference and plan for it

Frequently Asked Questions

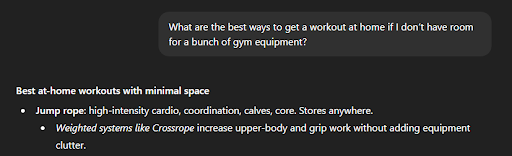

How do e-commerce customers actually buy in 2026?

They research first, compare options, leave, and come back later through a different channel. Very few convert on the first click, especially in competitive categories like supplements.

Why did Google Shopping traffic convert worse in 2025?

Because Shopping traffic now acts as mid-funnel discovery, not bottom-funnel intent. Conversion depends on follow-up content like comparisons, reviews, and expectation-setting.

Does creative really matter in Google Shopping ads?

Yes. Shopping feeds behave like creative units. Listings with visual context, value cues, and strong titles outperform sterile white-background product shots.

Is Performance Max still worth using in 2026?

Only if you fully control creative, asset groups, and messaging. Without tight inputs, PMAX fills gaps poorly and erodes brand clarity.

What’s the best way to defend branded search from competitors?

Content, not bidding. Educational blog content addressing misleading claims can outrank competitor ads faster than increasing spend.

Do third-party reviews actually drive sales?

They drive clicks and trust, but most conversions happen through organic discovery. Validation works best when buyers find it during research vs when it’s pushed.

Is YouTube still just a branding channel?

No. YouTube now influences purchases earlier and converts later. Shorts, UGC, and podcast host reads drive delayed conversions that standard attribution misses.

What actually drives Meta scaling at higher spend?

Creative volume and velocity. Testing 18–20+ new ads per month matters more than targeting tweaks once budgets increase.

What should e-commerce marketers change going into 2026?

Design full buying journeys. Build research content, treat feeds like ads, measure delayed impact, and expect competitor interference.

no replies