Why Global Expansion Fails for Smart Teams

Six-figure Shopify brands don’t fail internationally because they picked the wrong markets or had bad products.

Usually, it’s because they made architectural decisions in month one that created invisible bottlenecks by month twelve.

I’ve seen many smart teams get trapped.

A fashion brand that chose Markets Pro to “test quickly” and then burned $450K annually on a 9% fee structure they couldn’t escape.

A supplements company that built separate expansion stores for every market, then spent three months just trying to get unified analytics across their fragmented setup.

So, to help you get it right, this isn’t yet another “features comparison” guide.

By the end of this article, you’ll know how to make the right architectural choice without breaking your financials, the real costs at scale, when each architecture makes sense based on revenue thresholds, and how to avoid irreversible architectural debt that haunts you later.

Architecture Foundations: Shopify Markets vs Markets Pro vs Expansion Stores

Here’s what Shopify won’t tell you in their documentation: mature brands don’t pick one model and call it done.

They architect hybrid strategies based on market complexity, team structure, and financial thresholds.

For instance, One Retail Group migrated 7 brands from WooCommerce to Shopify Plus and deployed 12 international stores in 6 months, using a hybrid approach.

Pro Breeze (flagship brand) got 3 dedicated expansion stores for major markets (UK, EU, North America) with deep localization.

Smaller brands used Shopify Markets for long-tail regions. They built a single multi-store codebase so updates could roll out consistently across all properties.

Why this worked: They didn’t treat Belgium the same as Germany. High-value markets got the infrastructure they deserved. Testing markets got cost-effective validation.

The result: Rapid launch ahead of schedule with consistent UX across brands.

Organizational Architecture: Team Structure Drives Tech Decisions

Your team capability should determine your architecture as much as your revenue does.

Lean teams (3-5 FTE)

Markets/Markets Pro provides streamlined management. One marketing lead can configure new markets centrally, and Global-e handles tax/shipping complexity through Markets Pro.

Routine tasks only need to be done once across all regions.

Growing teams with regional expertise (5-15 FTE)

Expansion stores offer cleaner solutions when separate teams oversee each market. Country managers can log into their own store, avoiding permission issues and cross-market editing mistakes.

Larger organizations can choose their own merchant of record to reduce per-sale fees.

The operational reality: A 3-person team managing 15 markets through separate stores is operational suicide. A 20-person team with regional managers using one shared admin creates bottlenecks.

Revenue Thresholds That Actually Matter

Once a store hits mid-6-figures monthly internationally (~$500K/month), it typically makes more sense to manage local operations directly rather than pay the 9% Markets Pro fee.

Here’s a progression that works:

- Markets: Market validation, manage multiple regions from one dashboard

- Markets Pro: When compliance complexity justifies fees, until ~$6M international annually

- Expansion Stores: When control needs exceed single-store capabilities, typically >$1M per major market

- Hybrid: Geographic segmentation for different market tiers (where most $5M+ brands end up)

Financial Reality: What Each Model Actually Costs at Scale

Let’s use real TCO data from successful Plus merchants. I’ll model a $10M annual revenue brand with 50% international sales ($5M international) — typical for established brands ready for global expansion.

Total Cost of Ownership: The Real Numbers

Based on $10M annual revenue, 50% international sales

| Model | Shopify License | International Fees | Hidden Costs | Total TCO |

| Markets (Standard) | $28K/year | $100K/year (2% FX) | $50K-$100K¹ | ~$178K-$228K |

| Markets Pro | $28K/year | $450K/year (9%) | Minimal | ~$478K |

| Expansion Stores | $28K/year | $125K/year (2.5%) | $100K+² | ~$253K+ |

¹ Legal/accounting for VAT registrations, compliance management

² Team overhead for multi-store management, development costs

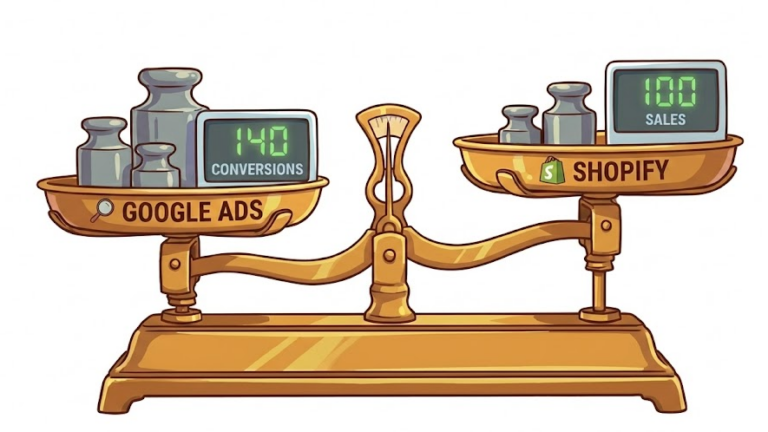

The Scale Shock: Where Fees Become Prohibitive

At $10M international revenue:

- Markets Pro fees: $900K annually (9% of $10M)

- Self-managed approach: ~$350K including operational overhead

- Difference: $550K that could fund inventory, team growth, or acquisition

At $20M international revenue:

- Markets Pro fees: $1.8M annually

- That’s more than most companies spend on their entire marketing stack

The critical inflection point: Once international sales exceed $500K/month ($6M/year), paying 9% starts costing more than self-managing cross-border operations.

Risk Assessment: What You’re Really Trading Away

Risk vs Control Assessment Matrix

| Factor | Markets Pro | Self-Managed | Impact Level |

| Vendor Dependency | High Risk | No Risk | Critical |

| Legal Liability | Transferred to Global-e | You Own | High |

| Data Control | Limited | Full Control | High |

| Fee Escalation Risk | High | None | Critical |

| Compliance Expertise | Not Required | Must Build | Medium |

| Customer Relationship Control | Shared/Limited | Direct Control | Medium |

| Transaction Documentation | Global-e owns | You own | High |

| Exit Flexibility | Difficult/Expensive | Full Control | Critical |

Vendor Lock-in: The Strategic Risk Nobody Discusses

The uncomfortable scenarios

- Global-e raises fees or changes terms (limited negotiating power until very high volume)

- Shopify phases out Markets Pro partnership (complete rebuild required)

- Global-e’s automated systems incorrectly flag products

Real merchant experience

Reports in the Shopify community show Markets Pro’s compliance bot flags products with ~0.5% false positives, with slow support for re-verification.

At $500K+ monthly international, even 0.5% blocked inventory significantly impacts revenue.

Data Ownership & Audit Considerations

Critical questions for $5M+ brands:

- Invoice control: Global-e issues final legal invoices; you see order data but don’t own legal documentation

- Audit trail: Can you obtain complete transaction/tax records if needed for audits?

- GDPR compliance: Both you and Global-e are “data controllers” with separate responsibilities

- Exit strategy: What data can you export if switching providers?

Before exiting Global-e, ensure you obtain complete transaction and tax records to transition to new solutions.

Technical Architecture Strategy: When to Use Each Model

Most brands think architecture is a one-time decision.

It’s not.

It’s a strategic evolution based on market performance, team capabilities, and financial thresholds.

Strategic Model Selection: The Decision Matrix

Stop guessing which model fits your situation. Use this framework based on real operational data from $5M+ brands:

| Factor | Markets | Markets Pro | Expansion Stores | Hybrid Approach |

| Revenue Threshold | <$500K intl | $500K-$6M intl | >$1M per major market | Varies by market tier |

| Team Size | Lean (3-5 people) | Growing (5-15) | Enterprise (15+) | Mixed teams |

| Compliance Expertise | Basic/None | Learning | Advanced/In-house | Varies by region |

| Control Priority | Low | Medium | High | Strategic markets high |

| Operational Complexity | Low | Medium | High | Managed complexity |

| Best For | Market validation | Compliance-heavy regions | Major market optimization | Most $5M+ brands |

The Architecture Evolution Roadmap

Phase 1: Markets (0-18 months)

- Market validation across 5-10 countries

- Centralized management from single dashboard

- Exit trigger: $50K monthly in any market

- Budget: <$500K total international revenue

Phase 2: Markets Pro (6-36 months)

- EU/UK compliance automation via Global-e

- 150+ local payment methods enabled

- Exit trigger: $500K monthly total international

- Budget: $500K-$6M annual international revenue

Phase 3: Hybrid (18+ months)

- Expansion stores for Tier 1 markets (>$1M annually)

- Markets Pro for Tier 2 compliance needs

- Markets for Tier 3 testing markets

- Most $5M+ brands end up here

Transition Planning: Avoiding Architectural Debt

The biggest mistake is not defining your exit criteria before committing to any model.

Switching Costs & Timeline

| Transition Type | Timeline | Technical Costs | Legal/Setup Costs | Risk Level |

| Markets → Markets Pro | 2-4 weeks | Minimal | $0 | Low |

| Markets Pro → Self-Managed | 3-6 months | $10K-25K | $15K-30K | High |

| Markets → Expansion Stores | 2-4 months | $10K+ per store | $5K-15K | Medium |

| Expansion Store Consolidation | 4-6 months | $15K-30K | Minimal | High (SEO risk) |

The App Compatibility Reality Check

Critical insight from practitioners: Not all apps work across different models. Inventory syncing apps may not recognize Markets’ subfolders.

Loyalty programs often break with international customer handling. Analytics apps need complete reconfiguration.

Before any transition: Audit your app stack. Document which apps need replacement, factor switching costs, and plan for potential feature gaps during transitions.

Future-Proofing Your Decisions

Decide on your transition thresholds upfront:

- “Move Market X to expansion store when it hits $100K monthly for 3 consecutive months”

- “Exit Markets Pro when fees exceed $75K quarterly”

- “Consolidate expansion stores if operational overhead exceeds 15% of international revenue”

Build transition budgets.

Factor 10-15% of annual international revenue for architecture evolution costs. Most brands underestimate this and get trapped in suboptimal structures.

Performance Factors That Drive Model Choice

Here’s what actually drives revenue — not feature marketing promises.

Conversion Impact by Localization Factor

| Factor | Impact Range | Markets Capability | Markets Pro | Expansion Stores |

| Local Payment Methods | 20-40% conversion lift | Limited (Shopify Payments) | 150+ methods | Full control |

| Cost Transparency | 15-25% cart completion | Basic estimation | DDP guaranteed | Configurable |

| Trust Signals | 10-20% confidence boost | Generic | Global-e branded | Market-specific |

| Local Currency | 40% conversion boost | Automatic | Automatic | Full control |

Regional Payment Preferences: What Actually Converts

| Region | Essential Methods | Trust Signals | Measured Impact |

| Germany | Sofort, Klarna | Trusted Shops certification | 23% checkout completion lift |

| Netherlands | iDEAL | Local business address | 15-20% trust boost |

| Sweden | Klarna, BNPL options | GDPR compliance statements | 20-30% conversion increase |

| Middle East | Cash on Delivery | Local phone numbers | 25-35% completion improvement |

The payment reality: Missing regional preferences signals to consumers that you’re not a legitimate local retailer.

Markets Pro’s 150+ payment methods often justify part of that 9% fee through conversion lift alone.

Cost transparency: Baymard Institute research confirms unexpected costs are a top cart abandonment driver. International customers want total costs upfront, not surprises at the point of checkout.

Markets Pro advantage: DDP (Delivered Duty Paid) with guaranteed landed costs eliminates delivery surprises. “Includes all taxes and duties” becomes a competitive differentiator worth premium pricing.

SEO Architecture: The Authority vs. Control Trade-off

| SEO Factor | Subfolders (Markets) | Separate Domains (Expansion) |

| Domain Authority | ✅ Consolidated across markets | ❌ Split, each starts from zero |

| Local SEO Signals | ❌ Weaker geo-targeting | ✅ Strong local search signals |

| Technical Setup | ✅ Automatic hreflang | ❌ Manual configuration required |

| Content Management | ✅ Unified updates | ❌ Duplicate work across sites |

| Migration Risk | ✅ Lower switching costs | ❌ High (4+ months recovery) |

| Local Keyword Optimization | ❌ Limited customization | ✅ Complete market control |

The Duplicate Content SEO Trap

The #1 international SEO mistake: Launching “localized” sites that are 90% identical content with only currency changes. Google can’t determine which version to rank.

At minimum, you need this localization depth:

- Product descriptions adapted for local search terms (“swimsuit” vs. “swimming costume”)

- Market-specific testimonials and social proof

- Cultural imagery and reference adaptation

- Local keyword research, not direct translations

Without proper content localization, SEO performance fails.

SEO Migration: Traffic Preservation Strategy

SEO Migration Checklist

| Step | Timeline | Critical Actions | Risk Mitigation |

| Pre-Migration | 4-6 weeks | URL mapping, content audit | Document all redirects |

| Technical Setup | 2-3 weeks | 301 redirects, hreflang updates | Test all redirect chains |

| Content Migration | 3-4 weeks | Ensure content parity/improvement | No content reduction |

| Monitoring | 3-6 months | Track rankings, traffic, conversions | Staged rollout by market |

Analytics & Attribution: The Multi-Store Challenge

The Data Fragmentation Problem

Expansion stores create operational complexity. Each store generates separate analytics properties, pixels, and conversion tracking.

Multi-touch attribution becomes nearly impossible — customers might click US ads but purchase on EU sites.

Shopify does not offer native multi-store dashboard. Businesses rely on third-party BI tools or custom data warehouses to see unified metrics.

So, factor $20K-$50K annually for proper analytics aggregation tools when using expansion stores at scale.

Returns Infrastructure Complexity

Markets Pro: Built-in international returns portal via Global-e. Recent Loop Returns + Global-e partnership aims to streamline cross-border returns, but many merchants still need separate returns apps for unified management.

Expansion Stores: Configure returns per region — UK returns to UK warehouse, APAC returns to Australia. Greater control but requires coordination across regions and potentially multiple 3PLs.

The duties refund complexity: When customers return international orders, who refunds the duties/taxes? Global-e handles this automatically. Self-management requires policy decisions and potentially absorbing those costs.

Performance Decision Framework

Choose Markets if:

- SEO authority consolidation outweighs local optimization needs

- Unified analytics and operational simplicity are priorities

- Limited resources for market-specific content strategies

Choose Markets Pro if:

- Local payment conversion lift justifies 9% fees

- DDP cost transparency critical for customer trust

- Compliance automation worth premium over building expertise

Choose Expansion Stores if:

- Local SEO performance critical for organic growth

- Resources available for deep market-specific optimization

- Customer experience control outweighs operational complexity

The hybrid approach for 6-figure brands:

- Tier 1 markets: Expansion stores for maximum optimization

- Tier 2 markets: Markets Pro for conversion + compliance ease

- Tier 3 markets: Markets for cost-effective validation

The Readiness Audit That Prevents $500K Mistakes

As the saying goes, asking the right question is already half the solution.

In this case, “Which Shopify model do we need,” isn’t the best question to ask.

“Are we organizationally ready for this model’s demands, and how do we preserve optionality as we scale?” is a much better question. Here’s how to answer that.

The Execution Readiness Audit

Before you commit to any architecture, audit whether your organization can actually handle what you’re choosing.

Markets Pro Readiness Checklist

Team Readiness:

- Dedicated person to manage vendor relationships and escalate Global-e issues

- Customer service team trained to handle disputes when Global-e is merchant of record

- Financial controls to monitor and reconcile Global-e’s consolidated invoicing

- Process for handling Global-e’s automated product restrictions and false positives

Systems Integration:

- Conversion tracking configured for Global-e’s checkout flow

- Attribution systems can handle Global-e domain switches

- Inventory management system compatible with Global-e’s product blocking

- Reporting infrastructure for international performance with limited transaction data visibility

Vendor Dependency Management:

- Backup plan documented if Global-e raises fees or changes terms

- Data export process identified for complete transaction/tax records

- Legal review of what happens to customer data if partnership ends

- Transition budget allocated for potential switch to self-managed

Expansion Stores Readiness Checklist

Operational Readiness:

- Team members assigned to manage separate store admins efficiently

- Processes for product launches across multiple stores without bottlenecks

- Brand consistency guidelines for separate storefronts

- Multi-store theme deployment and maintenance system

Analytics Infrastructure:

- Business intelligence tools to aggregate data across stores

- Multi-store attribution system for cross-border marketing campaigns

- Unified reporting dashboard for consolidated performance data

- Customer journey tracking across different regional stores

Compliance Management:

- Legal/accounting resources for VAT registration across jurisdictions

- Processes for manual product compliance restrictions per market

- International returns and refunds handling across multiple stores

- Tax filing and audit management for each active jurisdiction

The Transition Planning Framework

Plan your transitions before you need them. Start by defining your transition triggers.

For example:

- Financial Triggers: “We’ll transition from Markets Pro when international fees exceed $750K annually”

- Operational Triggers: “We’ll need expansion stores when we hire regional team members who need separate store access”

- Strategic Triggers: “We’ll need more control when vendor dependency risk exceeds operational convenience”

And, importantly:

- Reserve 10-15% of annual international revenue for architecture transitions

- Document current setup (integrations, customizations, data flows) to simplify future migrations

- Build internal capabilities during your current model’s learning period to enable future transitions

Transition Budget and Timeline Rules of Thumb

| Transition Type | Budget | Timeline | Critical Path |

| Markets Pro to Self-Managed | $25K-$45K total<br>($15K-$30K VAT registrations + $10K-$15K systems setup) | 6-9 months from decision to full transition | VAT registrations in active markets, tax calculation system setup, returns infrastructure |

| Single Store to Multi-Store | $15K-$30K per new store + $20K-$50K analytics integration | 3-4 months per major market | SEO migration planning, content localization, team training on multi-store operations |

The Strategic Implementation Checklist

Before you launch internationally:

- Audit organizational readiness for your chosen model’s operational demands

- Define financial and operational triggers that will force architecture transitions

- Budget for evolution – factor switching costs into your international expansion financial planning

- Document your setup to preserve flexibility for future changes

- Build transition timelines for when you’ll likely need to evolve your architecture

Success Metrics: How to Know Your Architecture Is Working

Financial Health Indicators:

- International revenue per FTE remains above $500K annually

- Architecture costs stay below 15% of international gross margin

- Customer acquisition costs in international markets within 20% of domestic CAC

Operational Efficiency Metrics:

- Time to launch new markets decreases over time

- Customer service resolution time for international issues matches domestic standards

- Team satisfaction with international workflow processes remains high

Competitive Position Indicators:

- International conversion rates within 10% of domestic performance

- Market share growth in target international markets

- Brand recognition and customer retention in international markets

The bottom line: Your international expansion will succeed or fail based on execution capability, not feature selection.

Audit your readiness, plan your evolution, and preserve your optionality.

The right architecture is the one your team can execute flawlessly today and transition from strategically tomorrow.

Book a free discovery call to get help from our specialists. No fluff. Just fast, actionable insight.

no replies